Tired of letting cash sit idle? Sidekick helps you make more of your money with access to high-yield savings and money market portfolios.

.png)

.png)

We only partner with trusted banks and regulated investment providers, and your savings and investments are covered by the Financial Services Compensation Scheme (FSCS).

.png)

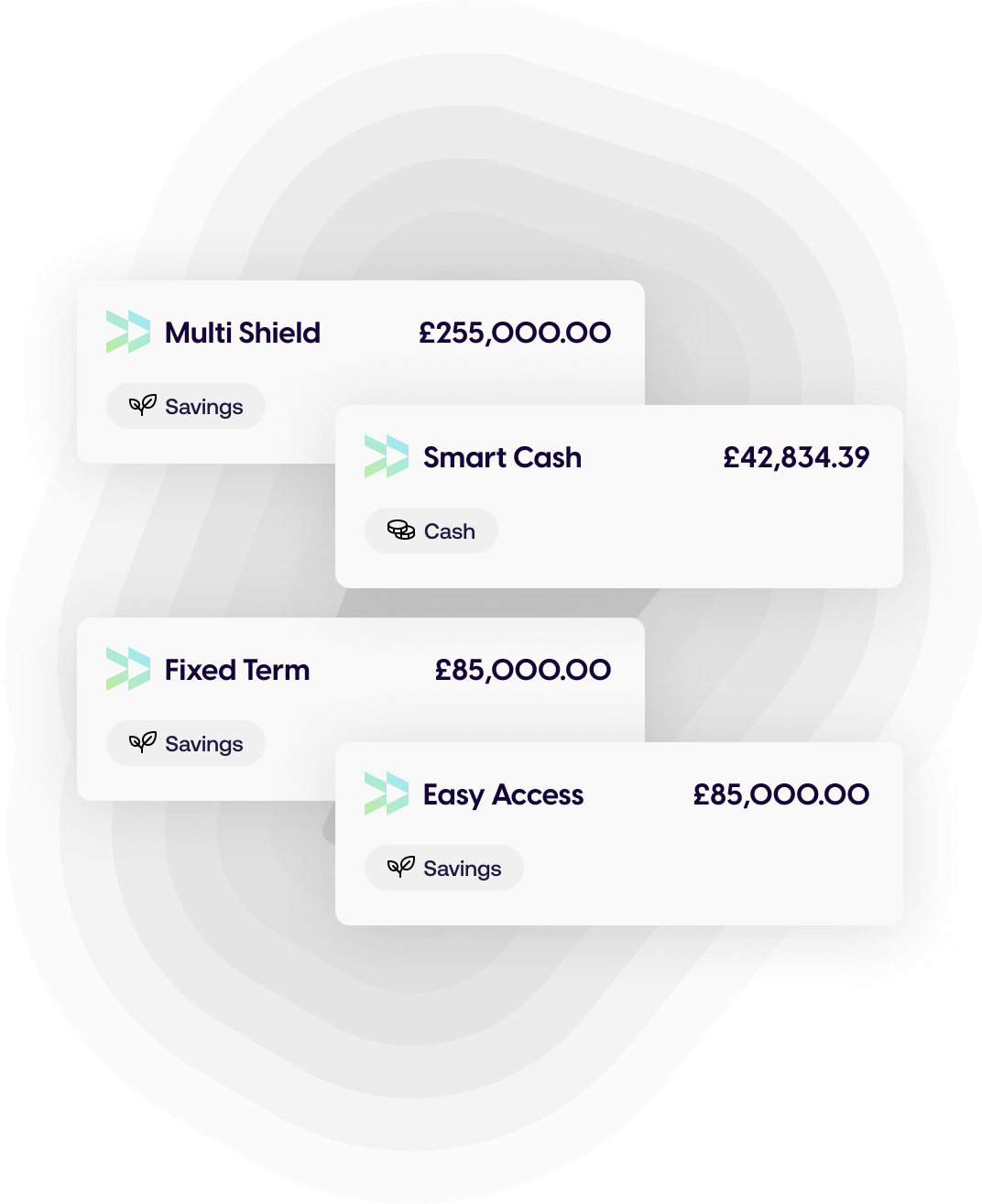

Savings protection: If a partner bank were ever to fail, your deposits are protected by the FSCS up to £85,000 per person, per bank. Our Multi Shield account spreads your savings across three banks to triple your protection.

.png)

Investment protection: If our investment custodian, Interactive Brokers (IBKR), were ever to fail, your investments are protected by the FSCS. Please note, FSCS protection does not cover changes in the market or investment performance.

.png)

.png)

.png)

Range of products

We offer a range of products, including Easy Access and Fixed Term Savings accounts.

Competitive interest rates

When you open a Sidekick savings account, you’ll earn interest directly from our trusted partner banks OakNorth and Hampshire Trust Bank.

Smart Cash is an actively managed investment product, which uses different money market and ETF instruments to deliver cash-like returns and liquidity. Unlike a savings account, your capital is at risk.

From time-to-time we apply bonuses to the underlying savings rates provided by our partner banks. We'll let you know when a bonus is available on a product, and if you're eligible.

Any bonuses will be paid directly into your Sidekick Wallet. The Sidekick bonus rates can vary at our discretion, but we'll notify you if this happens.

Our savings accounts are provided by OakNorth Bank and Hampshire Trust Bank - fully regulated UK banks.

OakNorth Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 629564).

Hampshire Trust Bank Plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority (Financial Services Register number: 204601).

Your deposits with OakNorth Bank and Hampshire Trust Bank are protected up to £85,000 per person per bank by the Financial Services Compensation Scheme (FSCS). Any deposits you hold above the limit are unlikely to be covered.